President Biden’s American Families Plan would take important steps toward requiring wealthy people to pay a fairer amount of tax on their income, much of which never faces income taxes or benefits from special low rates. The plan would also address the nation’s massive “tax gap” — the gap between what taxpayers owe and what they pay — which disproportionately reflects taxes not paid by those at the top. Contrary to overheated rhetoric by opponents of raising revenues from wealthy households, the President’s plan takes a measured approach to reforming the tax code’s treatment of wealthy households.

Income and wealth have become increasingly concentrated in recent decades as the fortunes of those at the very top have surged, while low- and middle-income people have seen much smaller gains. And even as the economic fallout from COVID-19 has harshly affected millions of Americans, wealthier households have largely prospered — a dichotomy known as the “K-shaped recovery.”[1] Against this backdrop, and with the nation facing significant investment needs, it’s vital that policymakers reconsider the special tax treatment that wealthy people enjoy.

Much of wealthy households’ income comes from capital gains, such as the increase in the value of corporate stock or real estate. Unlike wages or salaries, which make up the majority of most households’ income and are taxed each year, capital gains income benefits from “deferral,” meaning it isn’t taxed in a given year unless the asset is sold, which effectively allows the asset’s owner to decide when to pay tax.

The Biden plan wouldn’t eliminate this special treatment and would still allow wealthy people to not have to pay tax on a main source of their income year-to-year. (As noted below, proposals to adopt a “mark-to-market” system for taxing capital gains are designed to eliminate this advantage and to tax the capital gains income of wealthy people as it accrues each year.) But the Biden plan would require wealthy people to pay income taxes on a lifetime of previously untaxed capital gains when they die. Under current law, capital gains that people accrue over their lifetimes are simply erased when they die, so they don’t have to pay tax on capital gains income each year and neither they nor their heirs ever have to pay income tax on it. This is known as the “stepped-up basis” loophole because the asset’s basis — or the price originally paid for it — is “stepped up” to its fair market value at the time of inheritance, without anyone paying income tax on those accrued gains. The Biden plan would eliminate the stepped-up basis loophole for wealthy households.

Another tax advantage for wealthy households is that a significant share of the income that does show up on their annual tax returns — such as corporate dividends or “realized” capital gains income from a sale of stock or other property — is taxed at lower rates than the top rate on wages, salaries, and interest from savings accounts and corporate bonds. Tax policy changes in recent decades have expanded these tax advantages. The Biden plan would significantly reduce these preferences. Specifically, it would:

- Tax dividends and realized capital gains of very high-income households at the same rates as wage, salary, and interest income;

- Limit certain special tax benefits for “pass-through” businesses (including partnerships, S corporations, and sole proprietorships) by repealing a loophole that lets high-income pass-through owners avoid the 3.8 percent Medicare tax imposed on other types of income and by permanently limiting the amount of losses that high-income business owners can deduct against their non-business income;

- Eliminate other long-standing loopholes, including the “carried interest” loophole that benefits managers of investment funds and the “like-kind” exchange loophole, which allows wealthy real estate investors to avoid tax on their capital gains when they sell assets that have appreciated; and

- Raise the top marginal income tax rate back to 39.6 percent, the rate before the 2017 tax law.

These changes, together with repealing the stepped-up basis loophole, would raise $800 billion over ten years, according to Treasury.

The Biden plan also includes a major initiative to address the tax gap. The IRS fails to collect as much as $1 trillion of legally owed taxes each year, IRS Commissioner Charles Rettig recently testified.[2] Wealthy households’ contribution to the tax gap is substantial, recent research[3] suggests, largely through their use of offshore accounts and complex business structures that the IRS is ill equipped to uncover during audits given its current resources. Meanwhile, largely due to dramatic IRS budget cuts since 2010, audit rates of wealthy taxpayers have plummeted. The Biden plan would provide $80 billion in multi-year funding to rebuild the IRS’s enforcement function, including by hiring and training audit staff and upgrading its technology systems; the IRS and Treasury estimate this investment would generate $240 billion in net savings over ten years.

The plan would also target the largest source of the tax gap — underreporting of certain kinds of “low-visibility income” subject to little or no independent reporting that the IRS can use to verify information in tax returns — by adding an information reporting requirement for financial institutions that would allow the IRS to better detect underreported income. Treasury estimates that these new information reporting requirements would generate $460 billion over ten years.

Taken together, the President’s tax proposals — including the American Jobs Plan’s corporate tax reforms as well as the tax increases for wealthy households and tax compliance reforms discussed in this paper — would raise $3.3 trillion over the next decade, the Administration estimates, or less than 1.2 percent of gross domestic product (GDP). This is a modest cost to support investments that would shore up the nation’s infrastructure, expand access to health care, help parents afford child care, reduce child poverty markedly, and invest in education. Moreover, the increase would come from a historically low base: in 2019, after two decades of tax cuts, revenues stood at just 16.3 percent of GDP, compared to 20 percent of GDP in 2000, at a similar stage in the business cycle. Even with the Biden revenue increases, revenues would remain below their 2000 level relative to GDP.

This report outlines the Biden proposals related to wealthy households, including ending the stepped-up basis loophole for the very wealthy, taxing investment income more like income from work, and bolstering tax compliance.[4]

Income from capital gains currently enjoys several tax advantages. They include deferral of tax, elimination of any possible capital gains income tax liability when the owner of those assets dies (the “stepped-up basis” loophole), and a special discounted tax rate on realized capital gains (e.g., when a share of stock or other asset is sold). It is important to understand how these advantages work under current law and then to consider how President Biden proposes to change (and not change) them. The following examples of well-known business leaders (about whom financial information is publicly available) show the large benefits of deferring tax on capital gains, which President Biden’s proposal would not change, and the stepped-up basis loophole, which President Biden would eliminate for very wealthy households.

- Warren Buffett: His main asset, Berkshire Hathaway stock, rose in value by over $7 billion in 2010 alone, from about $34.8 billion to $42 billion.[5] But on his 2010 tax return (which he made public via a letter to then-U.S. House member Tim Huelskamp), Buffet’s adjusted gross income that year was $62.8 million, or less than 1 percent of that stock increase.[6]

- Jeff Bezos: Amazon’s filings with the Securities and Exchange Commission (SEC) show that he receives an annual salary of $81,840 (as of 2020),[7] which is subject to ordinary income taxes each year.[8] As founder, however, Bezos owns a significant share of Amazon stock,[9] and the value of his holdings grew by more than $100 billion between 2010 and 2018.[10] This $100 billion in income is only taxed when — or if — Bezos decides to sell some of his stock. Bezos sold Amazon shares worth roughly $6.3 billion between 2009 and 2018, according to SEC filings,[11] but the tax code ignores the rest of his $100 billion gain. Thus, his tax bill on a decade of stock sales likely was about $1.5 billion, or less than 1.5 percent of his increase in wealth due to the appreciation of his Amazon stock.

- Steve Jobs: As CEO of Apple, he received an annual salary of just $1, according to Apple’s SEC filings.[12] He also received Apple stock in the early 2000s, however, that was worth $75 million when he received it.[13] He likely paid income tax on the value of those shares when he received them as compensation. But because he never sold the shares during his lifetime, he never paid capital gains taxes on the massive gain as Apple’s stock skyrocketed.[14] At his death in 2011, his Apple stock was worth roughly $2 billion, and neither he nor his heirs will ever owe any income tax on its gain in value during his life.

These examples illustrate the large benefits of deferring tax on capital gains, which allows taxpayers to continue earning returns on money they would otherwise pay in tax — earnings that compound over time.[15] This dynamic, in which some of the wealthiest people in the country go through life without paying annual taxes on much of their incomes, has sparked proposals from Senate Finance Committee Chairman Ron Wyden[16] and others to shift to a “mark-to-market” system for taxing capital gains. Under this approach, capital gains above a certain threshold would be taxed annually as they accrue — effectively equalizing the income tax treatment between those who hold capital investments and those who earn wage and salary income and pay their taxes annually.[17]

The Biden plan takes a more modest approach and leaves the powerful tax advantage of deferral in place. Each year, wealthy people with large unrealized capital gains would continue to pay no tax on the increase in their wealth (that is, on this income), so they would pay very low effective tax rates overall. What the Biden plan would do is ensure that wealthy people eventually pay income tax on large unrealized capital gains accrued during their lifetimes (that is, gains larger than $1 million, or $2 million for a married couple, plus a special exemption of up to $500,000 for personal residences).[18]

Some might claim that the Biden stepped-up basis proposal, when combined with the estate tax, would amount to double taxation on the same income, but this argument is flawed. Much of the confusion seems to stem from the timing of these two taxes: both would be levied at approximately the same time (upon the decedent’s death). The irony should not be missed, however: this close proximity only occurs because of the special deferral benefit that lets certain wealthy people avoid income tax liability during their lifetimes, as opposed to a wealthy musician or entertainer who pays taxes annually, for example.

Despite this close timing proximity, there is no double taxation because there are (at least) two people involved — the decedent and the heir(s) — and each faces tax on a separate flow of income. The decedent has unrealized capital gains income that has accrued tax-free over a lifetime, and, at death, the decedent would pay that deferred tax. This more closely matches the taxation of a wealthy person who primarily has capital gains income with one whose earnings primarily come from income that faces annual taxation — such as a musician who receives royalties and appearance fees and pays annual taxes on that income. In both cases, the decedent pays income tax on the income they received during their lifetime, and the estate tax would then apply to the remaining windfall inheritance that flows to the heir, who is a separate person. (Though technically levied on the estate, the estate tax effectively falls on heirs, research shows.[19]) Furthermore, heirs owe no income tax on their inheritances — even though other types of earned and unearned income, such as lottery or gambling winnings, face income taxes. All in all, the decedent pays tax on a lifetime of accrued gain, and the heir pays tax on her windfall inheritance — and, thus, there is no double taxation.

The Biden plan would reduce but not eliminate the tax advantages that income from wealth enjoys over income from work. As discussed above, the plan would leave intact wealthy households’ ability to defer capital gains income throughout their lives, but would end the stepped-up basis loophole that allows large amounts of income to never be subject to the income tax. The plan would also return the top marginal income tax rate to 39.6 percent,[20] set the rate on capital gains and dividends at that same 39.6 percent for households with annual incomes over $1 million, and eliminate the loophole for “carried interest” (see below).

The plan also would repeal other special preferences for those with at least $400,000 in income. It would repeal a loophole that lets certain high-income business owners avoid a 3.8 percent Medicare tax that other high-income households pay, permanently extend a limitation on the losses that high-income business owners can deduct from their non-business income, and repeal the “like-kind” exchange loophole, which allows wealthy real estate investors to avoid tax when they sell an asset if they invest those resources in another property. Together, these changes on high-income and wealthy households would raise $800 billion over ten years, according to Treasury.

As explained below, the plan would improve economic efficiency and raise significant progressive revenue without undermining economic growth.

When two economically similar types of income are taxed at very different rates, opportunistic taxpayers (and their tax advisors) will exploit those rate differences by trying to turn as much of their higher-taxed income into lower-taxed income as possible. As Leonard Burman, former director of the Tax Policy Center (TPC) and one of the nation’s foremost tax policy experts, has written:

Virtually every individual income tax shelter is devoted to converting fully taxed income into capital gains. If you can transform $10 million of wages into [capital] gains, you can save over $2 million. With that kind of payoff, there is a whole industry devoted to inventing schemes [to take advantage of this tax shelter].[21]

The preferential tax treatment of capital gains and dividend income compared to income from wages, salaries, and interest is a glaring example of such an inefficiency in the tax code. Take the following two examples, which underscore the distortions the Biden plan would largely eliminate:

- Carried interest loophole. Instead of receiving a salary as an employee, a manager of a private equity fund or other investment fund receives carried interest — that is, a share of the fund’s profits — as compensation, even though they didn’t contribute a corresponding share of the fund’s capital. Carried interest is taxed at the capital gains rate, not the higher rates for wages and salaries. As a result, people who work at these types of firms are taxed more lightly than employees of investment banking firms who do similar work but receive a salary — as well as people who work for wages and salaries in nearly every other industry. Many experts have argued that carried interest should be taxed as ordinary income, like wages and salaries;[22] the Biden plan would take this important step.

- Utility company stocks vs. corporate bonds. An efficient tax code generally wouldn’t encourage one type of investment over another, but the current code’s preferential treatment of dividends and capital gains over other types of income does exactly that. For example, an investor may choose to purchase shares of a utility company that pays regular, stable dividends (where the current top tax rate is 23.8 percent) over corporate bonds that make regular, stable interest payments (where the current top rate is 37 percent).[23] This tax rate differential distorts investment decisions and may encourage less productive behavior. The Biden plan would eliminate this differential for households with annual incomes over $1 million by taxing capital gains, dividends, and interest at the same rate.

By narrowing the gaps between the taxation of capital gains and dividends on the one hand, and labor and interest income on the other, the Biden plan would encourage individuals and businesses to base their decisions on economics — not taxes. This would help resources flow to areas where they would be most productive instead of where the tax breaks and gaming opportunities are most plentiful.

The amount of capital gains revenue raised each year depends not only on the tax rate applied to this income but also on how many assets investors choose to sell. A higher rate could lead some investors either to wait to sell assets in hopes of a future rate cut or to hold on to the assets until death, at which point their accrued capital gains tax liability would be erased. While the Joint Committee on Taxation (JCT) and Treasury have long estimated that the capital gains rate that would raise the most revenue is around 30 percent,[24] this conclusion has been called into question. A recent study finds that investors are less responsive to rate changes than JCT assumes, concluding that “raising capital gains tax rates has sizable revenue-raising potential” and that the revenue-maximizing rate could be closer to 38 to 47 percent.[25]

Moreover, that study holds all other related policies constant. President Biden, however, is proposing a complementary policy of ending the stepped-up basis loophole, which would lessen wealthy people’s incentive to hold assets until death. Instead, they would be more likely to sell the assets when it made economic sense to do so, regardless of the capital gains rate. As a result, very wealthy people would likely pay tax on more of their income, which — in combination with the higher rate — would raise more revenue.

The revenue raised by the Biden capital gains proposal would be very progressive. The proposed top capital gains and dividend tax rate would affect fewer than 0.3 percent of taxpayers because it would only apply to people with incomes over $1 million in a given year. Repealing the stepped-up basis loophole would only affect those with more than $1 million of capital gains ($2 million for a wealthy couple) and also includes special exemptions for personal residences.

Wealthy households have benefited from substantially reduced taxes in recent decades. From the mid-1990s through 2017, the average federal tax rate (that is, the share of a household’s income it pays in federal taxes) for the top 0.01 percent — a group with annual incomes of $12.9 million or more[26] — fell by almost a fifth.[27] And the 2017 tax law delivered another round of windfall tax cuts to wealthy households.[28]

Those tax cuts also significantly reduced federal revenues. In 2000, federal revenues stood at 20 percent of GDP; in 2019, similarly at a peak in the business cycle, they were just 16.3 percent — far too low to support the investments needed for a 21st century economy that broadens opportunity, supports workers, and ensures health care for everyone. In 2019, the difference between revenues at 20 percent of GDP and 16.3 percent was about $780 billion.

The Congressional Budget Office projects that revenues as a share of GDP will edge up modestly in the coming decade under current law but will only average 17.3 percent while the 2017 tax cuts are in full effect.[29] Even with President Biden’s proposed tax changes — including those in both the American Families Plan and the corporate tax proposals in the American Jobs Plan[30] — revenues as a share of GDP will remain below 20 percent over the next decade. To be sure, 2000 represented a peak in revenues as a share of the economy, but in that year the nation still faced sizeable investment gaps. In that year, some 14 percent of people lacked health insurance,[31] the maximum Child Tax Credit stood at just $500 and did little to lift children out of poverty,[32] and child care and housing assistance programs didn’t reach most people who needed help.

Beyond the Biden proposals discussed in this report, below is a sampling of other progressive revenue-raising options that could, for example, help pay for investments such as making the American Families Plan’s expansion of the Child Tax Credit permanent.

- Repeal the pass-through deduction for high-income business owners. The 2017 tax law created a 20 percent deduction for certain pass-through business income, which owners of businesses such as partnerships, S corporations, and sole proprietorships report on their individual tax returns. The deduction, which primarily benefits high-income households, encourages them to reclassify their salaries as pass-through profits to take advantage of the deduction. During the campaign, President Biden proposed phasing out the deduction for households with more than $400,000 in income. This would raise $143 billion over ten years, TPC estimated.a

- Restore a meaningful estate tax. Policymakers have cut the estate tax over time to the point where fewer than 1 in 1,000 estates — that is, only the very largest estates in the country — now owe any estate tax. A more robust estate tax is necessary to ensure that wealthy heirs pay their fair share. For example, restoring the rules in place in 2009, when the first $3.5 million of an estate’s value ($7 million for a couple) was exempt from the tax and the top rate was 45 percent, would raise at about $220 billion over ten years, according to TPC.b

- Limit itemized deductions of high-income households. During the campaign, President Biden proposed establishing a 28 percent cap on the value of itemized deductions for taxpayers with incomes of over $400,000. A household in the top tax bracket (39.6 percent under President Biden’s proposal) would receive, for instance, a tax reduction of 28 cents per dollar of eligible mortgage interest instead of 39.6 cents. This would raise around $220 billion over ten years, according to TPC.c

- Enact an AGI surtax on high incomes. To prevent wealthy filers who benefit from preferential rates and other tax avoidance strategies from largely escaping the top income tax rate — and to raise additional revenues from those with the highest incomes — policymakers could enact a surtax on adjusted gross incomes (AGIs) over a given threshold. In 2009, the Joint Committee on Taxation estimated that a 5.4 percent surtax on AGIs above $500,000 for individuals and $1 million for joint filers would raise $460 billion over ten years.d (A surtax proposal could include more than one rate to impose higher taxes on the very highest-income households.)

- Reform the taxation of stock buybacks. Policymakers should consider reforming the preferential tax treatment of stock buybacks, in which a corporation distributes profits to shareholders by repurchasing a certain number of shares, which increases the stock’s price and stockholders’ wealth. Stock buybacks are currently taxed as capital gains and thus benefit from deferral. A proposal from Professors Daniel Hemel and Gregg Polsky, for example, would treat stock buybacks similarly to dividends, which are the other major way corporations distribute profits to shareholders. They estimate their proposal could raise $70 to $80 billion per year.e

a Gordon B. Mermin et al., “An Updated Analysis of Former Vice President Biden’s Tax Proposals,” Tax Policy Center, November 6, 2020, https://www.taxpolicycenter.org/publications/updated-analysis-former-vice-president-bidens-tax-proposals.

b Ibid.

c Ibid.

d Joint Committee on Taxation, “Estimated Revenue Effects Of The Revenue Provisions Contained In H.R. 3962, The ‘Affordable Health Care For America Act,’ Scheduled For Consideration By The House Of Representatives,” November 7, 2009, https://www.jct.gov/publications/2009/jcx-53-09/.

e Daniel J. Hemel and Gregg D. Polsky, “Taxing Buybacks,” Yale Journal on Regulation, Vol. 38, 2021, https://digitalcommons.law.yale.edu/yjreg/vol38/iss1/4/. The Hemel and Polsky proposal is based on ideas from a 1969 article by Marvin Chirelstein.

Critics of taxing income from wealth like income from work often argue that doing so would stifle economic growth by reducing the return to capital investment; critics also argue that higher income tax rates on top earners would discourage economic activity. Yet these beliefs, which have been subject to extensive research and analysis, don’t fare well under scrutiny.

Most notably, a landmark study by University of California Professor Danny Yagan (now chief economist at the Office of Management and Budget) found that “the 2003 dividend tax cut — one of the largest changes ever to a US capital income tax rate — had no detectable near-term impact on the real outcomes it was projected to improve.”[33] Specifically, it “caused zero change in corporate investment and employee compensation” while providing a windfall payout to shareholders.

This study is of central importance in the capital gains policy discussion for several reasons. First, its findings are highly credible. The study took advantage of the natural experiment afforded by the 2003 dividend tax cut to directly compare changes in investment and employee compensation between C-corporations (which pay dividends and thus are subject to dividend taxation) and S-corporations (which don’t pay dividends), controlling for other ways in which these companies differ. It found that investment and employee compensation evolved no differently across affected and unaffected companies after the large change in the dividend tax rate, meaning the rate cut had no discernible impact on those outcomes. Second, the study examined a large change in tax policy (a drop in the top dividend rate from 38.6 percent to 15 percent); if cutting the rate were going to have significant economic consequences, one would expect to see them here.

This study is also consistent with other evidence. Leading tax scholar Joel Slemrod has noted that “there is no evidence that links aggregate economic performance to capital gains tax rates.”[34] A Congressional Research Service (CRS) report finds that cuts in the top capital gains rates since 1945 “have had little association with saving, investment, or productivity growth.”[35] TPC has reported that capital gains taxes have little apparent effect on stock market growth. “Arguments that the maximum [capital gains] tax rate affects economic growth are even more tenuous,” according to TPC, which finds no statistically significant correlation between capital gains rates and real GDP growth during the last 50 years.[36]

There are several reasons why capital gains tax changes have had little impact on outcomes such as savings, investment, and growth. Tax increases could lead taxpayers to save and invest less by reducing their after-tax returns, but could also lead them to save and invest more to offset the tax increase and meet their savings goals. Empirical evidence shows that these two effects roughly balance out. According to CRS, “Savings rates have fallen over the past 30 years while the capital gains tax rate has fallen. . . . This suggests that changing capital gains tax rates have had little effect on private saving.”[37]

Additionally, anti-competitive “rent-seeking” behavior — businesses’ manipulation of markets or government policies to protect and expand their profits — has increased in recent decades, as many industries have become more concentrated in the hands of fewer and larger businesses.[38] Rent-seeking generates profits beyond the level required to encourage businesses to undertake activities like investment, which means there is room to tax their excess profits without discouraging those activities. (That’s because even with the higher tax, the activity remains profitable.) Rent-seeking behavior among corporate executives and in the financial services sector is disproportionately contributing to skyrocketing compensation growth for the top 1 percent and top 0.1 percent, according to the Economic Policy Institute; thus, “multiple possibilities exist for redistributing these rents without slowing overall economic growth or distorting economic efficiency.”[39]

Similarly, the Biden proposal for a modest increase in the top marginal individual rate (from 37 percent to 39.6 percent) would likely have little effect on growth. The same logic discussed above regarding capital gains taxes and savings applies to income taxes and work: by reducing a person’s take-home pay from each hour of work, an increase in income taxes could lead them either to work less (because work would pay marginally less) or to work more (in order to maintain the same after-tax income). These two effects appear to largely offset, as the evidence shows that tax-rate changes within the ranges that policymakers generally consider have little impact on high-income individuals’ decisions regarding how much to work.[40] As former TPC head Leonard Burman has explained, “Overall, evidence suggests [high-income Americans’] labor supply is insensitive to tax rates.”[41]

In fact, with little loss of economic efficiency from raising taxes on the most well-off but major equity gains from providing assistance to low- and middle-income households, MIT economist and Nobel laureate Peter Diamond and University of California economist Emmanuel Saez argue that “Very high earnings should be subject to rising marginal rates and higher rates than current U.S. policy for top earners,” with optimal top rates above 50 percent.[42]

Finally, it is also important to note that the Biden recovery proposals — both the American Families Plan and the American Jobs Plan — would use the revenue from raising taxes at the top and from profitable corporations to finance high-return public investments that promote more broadly shared prosperity. Those investments would produce a historic reduction in child poverty by expanding the Child Tax Credit; help millions of families get affordable, high-quality child care; increase access to affordable health care; expand educational opportunity by investing in universal pre-K, making two years of community college free to all, and making higher education more affordable by increasing Pell Grants and reducing tuition at HBCUs and institutions that serve large numbers of Latino and Indigenous students; create a permanent paid family and medical leave program; and shore up the nation’s physical infrastructure and expand the stock of less expensive housing.

The combined effects of these Biden revenue and investment proposals on the economy are positive, according to a nonpartisan economic analysis from Mark Zandi and Bernard Yaros of Moody’s Analytics.[43] They found that under the American Families Plan and American Jobs Plan, “the economy’s long-term growth prospects are brighter.” This accelerated growth owes in part to increased educational attainment. In addition, Zandi and Yaros highlight that:

- “The impact on the economy from the higher taxes on high-income and wealthy households in the [American Families Plan] is small, in part because the tax increases are modest.”

- “[T]he financial benefits of that added growth largely accrue to hard-pressed lower-income and less-wealthy Americans.”

- “[T]he well-to-do have arguably never been in a better financial position given the long-running skewing of the income and wealth distribution and the surge in asset values during the pandemic. They are not likely to appreciably change their spending and saving behavior because of the tax increases in the [American Families Plan].”

Several factors have coalesced to create an urgent need to launch a multi-year rebuild of the IRS. Overall IRS funding is down one-fifth since 2010, and a decade of budget cuts has severely undermined the agency’s ability to perform its fundamental jobs of enforcing the nation’s tax laws and helping taxpayers navigate a tax system that relies on voluntary compliance. Since 2010, the number of revenue agents — auditors uniquely qualified to process the complex returns of high-income individuals and corporations — has fallen by 39 percent. New research underscores the extent to which some wealthy filers evade paying their fair share of tax and the IRS’s failure to detect it,[44] which is unfair to honest taxpayers and risks undermining the integrity of the tax code. Former IRS Commissioner Charles Rossotti estimates that $574 billion in legally owed taxes went uncollected in 2019.[45] New research indicates this may be an understatement.[46] In fact, current IRS Commissioner Rettig said recently the figure could exceed $1 trillion.[47]

As a recent CBPP report explained, an IRS rebuild needs to be multi-year, and sufficiently robust and certain, to allow the IRS to hire and train enough sophisticated audit staff to meet the 21st century tax evasion challenges it faces and to make and implement technology commitments to upgrade its computer systems.[48] Coupling funding multi-year funding increases with new requirements to expand information reporting for income that tends to be underreported would significantly boost revenues. The Biden plan proposes just such a two-pronged, complementary approach.

The plan includes $80 billion in multi-year tax enforcement funding to rebuild the IRS’s audit staff and upgrade its technology systems. The Treasury and IRS estimate this investment would yield $240 billion in net revenue.[49]

In addition, the plan includes a new information reporting requirement for financial institutions to improve tax compliance, which the Treasury and IRS estimate would raise $460 billion over ten years. Altogether, the Biden plan’s IRS rebuild and tax compliance initiative would raise an estimated $700 billion over ten years.

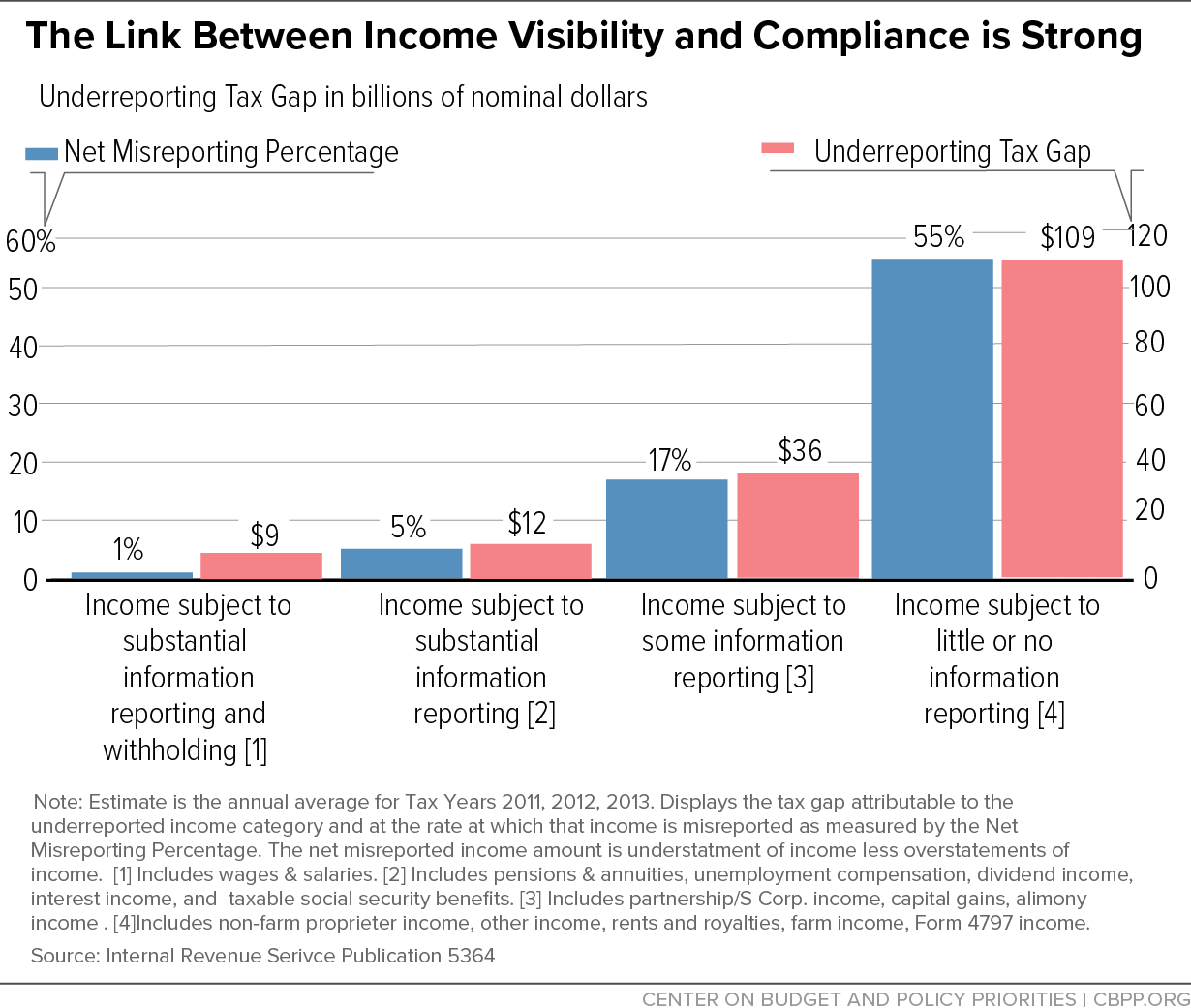

The compliance proposal recognizes the critical link between information reporting and tax compliance. Wage and salary earners (see group 1 of Figure 1) have very high rates of tax compliance, in large part because employers are required to report their incomes to the IRS and withhold taxes owed, and employees know the IRS has this information. Similarly, the IRS receives information from financial institutions on taxpayers’ dividend and interest income, so compliance is also high in these areas. The IRS, however, has little or no information on other types of income such as from partnerships (group 3) and sole proprietors (group 4). This opaqueness poses a major compliance challenge for the IRS and is a key reason the tax gap is so large.[50]

To improve compliance, the Biden plan would require financial institutions to add two pieces of information to a common form (1099-INT) that they already provide to many taxpayers with income from financial accounts: the overall amount of money flowing into an account each year and the overall money flowing out. Taxpayers would not have to take any additional steps. But, like wage earners whose employers report their income to the IRS, they would know that the IRS has the information and thus would have an incentive to accurately report their income to avoid an audit. And the IRS would have new data to use to detect when income is not being reported.